“`html

Employment & Economy

Recall the days when corporate America avoided engaging in politics on social media?

Elisabeth Kempf.

Stephanie Mitchell/Harvard Staff Photographer

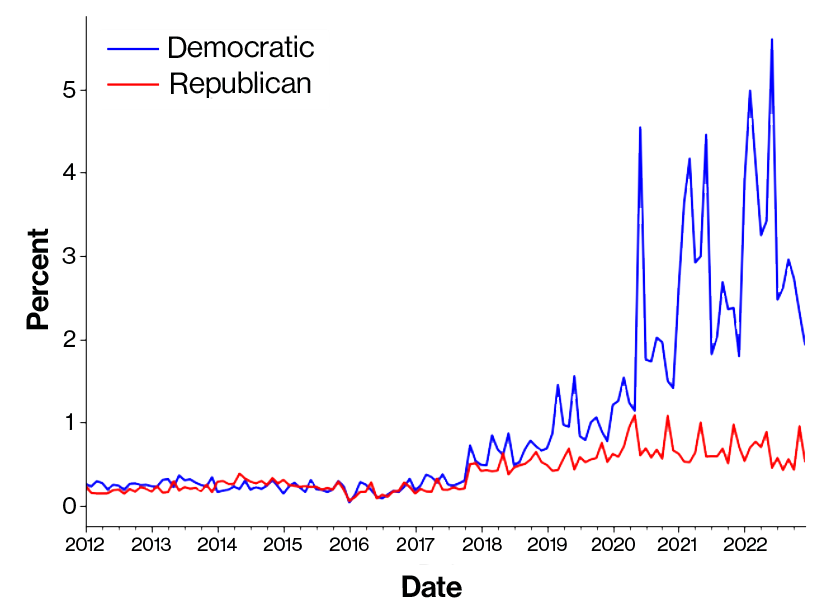

Research reveals a Twitter increase commencing in 2017, predominantly Democratic-leaning from an unexpected variety of firms, with adverse impacts on stock prices

There was a period when corporate America wasn’t heavily engaged online. Most businesses utilized social media primarily for marketing their offerings or for lighthearted interactions with consumers. Political content on company Twitter accounts was seldom observed.

That shifted dramatically from 2012 to 2022, as the amount of partisan commentary on Twitter (now referred to as X) from major corporations surged, more than doubling after 2017, as per a recent working paper from the National Bureau of Economic Research .

According to researchers, this surge was chiefly influenced by firms employing language synonymous with Democratic officials. This trend frequently resulted in negative repercussions for corporate stock prices.

In this modified dialogue, the paper’s coauthor Elisabeth Kempf, Jaime and Raquel Gilinski Associate Professor of Business Administration, sheds light on the sudden transition in corporate Twitter activity.

It seems omnipresent today, but corporations issuing partisan-flavored tweets is a relatively recent phenomenon. What were your findings?

Partisan commentary was exceedingly uncommon for businesses. Fewer than 1 percent of all tweets sent between 2012 and 2017 would qualify, based on our criteria, as highly partisan discourse.

Diving into contentious, polarized topics can be challenging for companies. We observed the first significant shift in 2017 when both Democratic and Republican partisan expressions saw an uptick, followed by a marked asymmetry starting in 2019.

That aspect struck me as the most unexpected. I anticipated that some companies would also begin to use more Republican-aligned language — essentially to witness evidence of polarization. It was quite astonishing that nearly every company seemed to embrace more Democratic rhetoric post-2019, occurring universally across firms in blue states, red states, and both consumer-facing and B2B [business to business] sectors.

“It was quite astonishing that nearly every company seemed to embrace more Democratic rhetoric post-2019 and that it was occurring universally, across companies in blue states, red states.”

How did you characterize partisan corporate commentary?

We built on earlier work conducted by Jesse Shapiro, my colleague at Harvard, along with his co-authors. They developed a methodology to examine partisan speech in Congress, identifying phrases that can help accurately infer a speaker’s political affiliation.

We adapted their methodology to analyze tweets issued by Democratic and Republican officials. This enabled us to pinpoint highly partisan phrases and subsequently apply them to corporate communication. Essentially, phrases that could plausibly originate from either a Democratic or Republican official are what we define as partisan commentary.

What insights did you gain regarding the evolution of partisan corporate speech over time?

The first observation is that partisan corporate speech has become increasingly prevalent during the 2012 to 2022 timeframe. The second observation is that this growth was notably asymmetric. Beginning in 2019, there was a swift increase in Democratic-tinged commentary, while Republican-leaning expressions remained steady or potentially even diminished towards the end. Lastly, our examination of stock performance following these partisan corporate statements reveals a tendency for negative abnormal stock returns.

That being said, we also note considerable variability depending on the composition of investors. For instance, if there are more funds with ESG [environmental, social, and governance] goals, then stock returns following a Democratic-leaning statement tend to be less negative.

Corporate partisan tweets through the years

Is it evident why these partisan Twitter communications escalated during this timeframe?

In 2017, we observed both Democratic- and Republican-sounding remarks increase for the first time. We don’t have extensive insights on that.

What we can elaborate on is the moment we began to see this rift between Democratic and Republican-sounding expressions, which occurred in January 2019. That was the time when BlackRock CEO Larry Fink released a notably impactful letter, his “Dear CEOs” annual correspondence. He specifically urged CEOs to vocalize more and take firm stances on polarizing matters.

This could provide further evidence indicating that large institutional investors might have also contributed to this shift. BlackRock, being the largest asset manager globally, was widely reported to have sparked extensive conversations in the business realm.

Furthermore, in 2019, the Business Roundtable [a CEO advocacy group] declared that maximizing shareholder value should not be the exclusive aim. Thus, I believe it had a significant influence.

We also find that 2019 was

“““html

A substantial increase in the assets under management featuring a sustainability mandate. This is when a significant transformation occurred within the investment sector.

Lately, we’ve observed protest movements against Tesla and Bud Light ignited by perceived partisan corporate communications. Could significant consumer boycotts that jeopardize profits have played a role in share declines, as opposed to merely public or investor responses to these statements?

This was the conclusion we found most challenging to comprehend. One possibility is, as you mentioned, that there may be elements of this partisan rhetoric that influence what we refer to as cash flows in finance or the profits generated by these firms. For instance, they might be losing staff or customers. We contend that partisan rhetoric can impact a third potential stakeholder group—investors—and how much they are inclined to retain the stock.

We were examining the 500 largest corporations by market capitalization, which are substantial firms that require capital from quite a diverse investor base. It’s challenging for these major companies to attract capital exclusively from Democrats or solely from Republicans. Therefore, once a partisan statement aligns with one faction but not the other, you could precisely observe this adverse stock price impact.

Additionally, it is challenging to account for the rise of Democratic-leaning statements solely through consumer or employee preferences. To clarify: we wouldn’t claim that investor or consumer preferences didn’t contribute at all. However, we believed it was essential to highlight that it was difficult to attribute everything just to consumers or just to employees.

Why is that? Because we observe this rapid surge for companies in both consumer-facing and non-consumer-facing sectors. Boycotts may elucidate why certain retail firms might adopt particular rhetoric, but we observe it even in materials, which consists of companies dealing with metals, chemicals, coatings, and so forth. It’s hard to envision that consumer preferences for partisan rhetoric would be exceedingly strong in that sector.

I assumed employees might be quite significant, yet we identified the same pattern in companies with staff based in highly Democratic regions versus Republican regions. We also did not find that labor market competitiveness had an influence. One might speculate that if you are urgently in need of talent, you might engage more in this partisan rhetoric if you believe it would aid in recruitment.

There were several findings that merely made it difficult to clarify this with consumers or employees alone. Conversely, if you consider this investment channel, it could elucidate why we see it in companies situated in blue regions, red regions. It could shed light on why this is such a widespread phenomenon.

Are there additional facets of corporate communication that warrant further exploration?

Indeed. I don’t believe we have entirely resolved the inquiry concerning why this considerable shift occurred at that time. We possess suggestive evidence indicating that investors might have played a part. However, I don’t think there is yet a complete, causal relationship. So that remains a significant open question: How impactful were investors compared to consumers or employees?

The second inquiry regards the longer-term implications. We are examining stock prices over a relatively brief period. What does this imply for companies in the long term, and potentially also for their relationships with politicians or how corporate partisan communication influences politics? I think these are intriguing areas for future investigation.

“`