Numerous events have transpired in the fortnight following “Liberation Day,” the date when President Donald Trump enacted extensive tariffs, which included a blanket 10% duty on all imports and additional reciprocal tariffs on certain countries’ imports.

From a worldwide market collapse and an unparalleled trade conflict to a 90-day suspension of tariffs for various nations, halted trade discussions with the European Union, escalating tariffs on China, and exemptions that appear to change continuously, the situation can be challenging to monitor.

In the following sections, John Horn, an economics professor at Olin Business School at Washington University in St. Louis, discusses how tariff ambiguity and bewilderment are fueling market instabilities — along with possible effects on long-term economic patterns.

What prompted Trump to delay some temporary reciprocal tariffs last week?

I believe there was considerable pressure accumulating towards that moment, especially from the bond selloff and the stock market. Earlier in the week, rumors circulated that tariffs would be suspended, which resulted in a significant recovery in the stock market. This created added pressure on the administration to implement changes.

What is the current status of the tariffs?

It’s evolving daily. While the 90-day suspension on reciprocal tariffs was a positive development, that constitutes merely one aspect of the larger situation. We still have a 10% blanket tariff on all merchandise. For perspective, at the end of 2024, the average tariff rate on all imports was 2.5% — and 2% for industrial goods — signifying an increase of four to five times. Concurrently, the tariff on Chinese products has risen to 145%.

What is the impact on the economy?

I do not believe the suspension of reciprocal tariffs has alleviated any investor uncertainty. The volatility in the stock market reflects this. Heightened tariffs imply continued price hikes and inflation, raising the likelihood of a recession. The escalating trade conflict with China, the second-largest importer to the United States after Mexico, exacerbates these worries.

Another troubling trend is evident in the bond market, which serves as a crucial barometer of longer-term economic expectations. The bond selloff is likely a consequence of other nations divesting from their Treasuries in response to the tariffs, alongside other buyers becoming anxious regarding the U.S. economy’s long-term health and the government’s capacity to honor those bonds (i.e., avoid default).

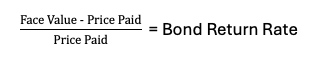

Why is this significant? Initially, bond prices adhere to the typical supply-and-demand principle: as demand diminishes, the price diminishes. However, this reduction in price actually results in higher returns for investors. That return is calculated by the difference between the bond’s face value (which remains constant) and the price you pay (which decreases), divided by the pay price. The difference between the face value and the cost paid increases, and dividing a larger number by a smaller one yields a more considerable outcome.

The repercussions extend beyond that. When interest rates for U.S. debt rise, other interest rates follow suit. If this didn’t occur, investors would solely purchase U.S. debt due to superior yields. Consequently, credit card interest rates, mortgage rates, and auto loan rates will also surge. Before long, we’re heading towards a recession.

This likewise indicates that government debt rates will increase. This will affect the federal government down to individual local governments, as it will become more expensive to issue new debt to continue financing government operations.

Last week, the Federal Reserve reported that the consumer price index for March increased 2.4% annually, a lower figure than what economists had anticipated. How does this influence the overall economic forecast?

The inflation figures were lower mainly due to fuel and transportation services, particularly airlines. These variables tend to fluctuate and will likely surge again as summer approaches. Inflation expectations have also been on the rise, as indicated by the University of Michigan consumer sentiment survey. If the tariffs on China remain, inflation will escalate since we import a significant amount from China. Even if alternative suppliers from other countries are found, prices will still probably be higher due to increased demand for those suppliers, and because they are less efficient overall — otherwise, we would already be purchasing from them.

What do you perceive to be the administration’s end goal? Do you believe this approach could yield improved trade agreements for the U.S.?

The administration’s strategy is challenging to decipher as it is unclear what the goal is. Reports indicate it might involve bringing manufacturing back to the U.S., enhancing tariff revenues, stimulating the U.S. economy, or a means to lower tariffs from other countries, among various other possibilities. However, these aims conflict. If we boost tariff revenues, it suggests ongoing imports rather than domestic production. Alternatively, if manufacturing growth occurs, then imports will reduce, thus yielding fewer tariff revenues. If the intent is to reduce tariff rates from other countries, we would still engage in purchasing from them, which does not promote manufacturing or tariff revenues, and tariffs are essentially taxes that result in diminished economic activity.

As for the trade agreements the administration has pledged, compelling negotiations is typically beneficial only in precisely tactical, winner-take-all situations — and even then, it may not always apply. The standard guidance for negotiation is to pursue win-win scenarios and cultivate relationships that facilitate continued negotiation over time. International trade and relationships are sustained interactions, so negotiation strategies usually favor relationship-building and win-win pursuits. It’s unclear how the strategies from the administration will achieve those results.

What would you recommend businesses do during this period of economic unpredictability?

The most prudent course of action for businesses would be to adopt a more cautious investment and expenditure strategy. No single company can revamp the U.S. supply chain and manufacturing landscape, thus being at the forefront puts you at risk amidst the looming challenges. Regrettably, if every business embraces this perspective, no one will venture to lead in reconstructing future economic systems. Typically, these responsibilities are undertaken by government entities, but this administration appears to be heading in the opposite direction — diminishing the involvement and initiatives of the government in the economy.

The article How tariff uncertainty will impact economy, businesses was originally published on The Source.