The sentiment of consumers has declined for the fourth consecutive month, dropping 8% from March and registering its lowest value since July 2022.

Although the decrease in current circumstances during April was relatively slight, the expectations index experienced a significant drop due to declines in both personal finances and business conditions, noted economist Joanne Hsu, the head of the University of Michigan’s Surveys of Consumers.

Expectations have plummeted a dramatic 32% since January, marking the steepest three-month percentage drop since the recession of 1990. This month’s downturn was especially pronounced among middle-income households, while the outlook on the economy for both the short and long term deteriorated for large segments of the population, regardless of age, education level, income, or political allegiance.

“Consumers are aware of the risks associated with various elements of the economy, largely due to ongoing uncertainties surrounding trade policies and the looming possibility of renewed inflation,” Hsu expressed. “Most concerning, consumers foresee weaker income growth in the upcoming year. Without consistently strong incomes, expenditures are unlikely to stay vigorous amidst the numerous warning signs identified by consumers.”

Widespread anxiety regarding trade policy

Consumers have voiced increasing anxiety over the developments in economic policy. Approximately 60% of consumers this month spontaneously mentioned tariffs during discussions, a significant rise from 44% in March.

This month’s statistics reflect that 59% of Independents and 44% of Republicans referred to tariffs, indicating that these tariff-related worries are prevalent across the political spectrum, Hsu stated.

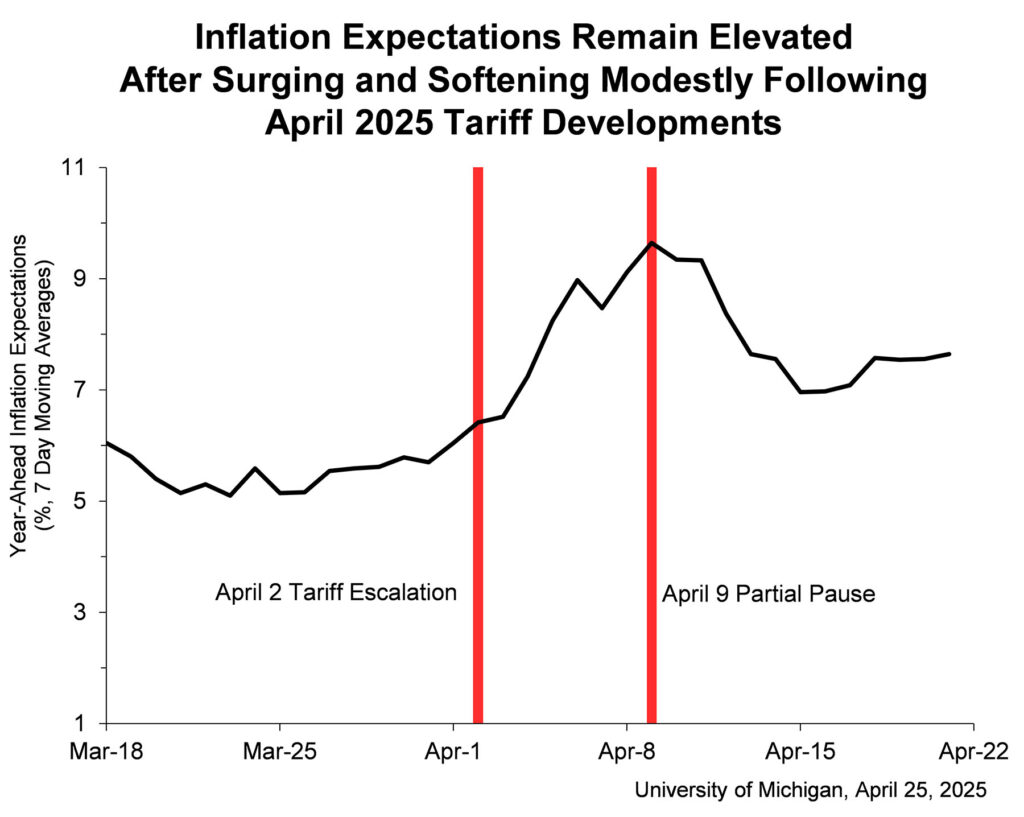

Significantly, these consumers generally anticipate that tariffs will create considerable upward pressure on inflation in the future and adversely affect the projections for economic growth as well. While the announcement on April 9 regarding a partial halt to tariff increases may have been viewed as a positive event, it was insufficient to alleviate consumers’ concerns about the potential effects of trade policy on the economy, Hsu noted.

Labor market outlook remains grim

Nearly two-thirds of consumers expect an uptick in unemployment over the next year, more than double the figure from six months prior. Disturbingly, consumers are increasingly anxious that their income prospects could be declining as well, Hsu remarked.

Fewer than half of consumers anticipate their incomes will rise in the upcoming year, a drop from nearly 60% six months ago. Approximately 67% of consumers expect that their purchasing power will diminish over the next year, an increase from 59% in October 2024.

Consumer Sentiment Index

The Consumer Sentiment Index has decreased to 52.2 in the April 2025 survey, down from 57.0 in March and lower than last April’s 77.2. The Current Index dropped to 59.8, down from 63.8 in March and beneath last April’s 79.0. The Expectations Index fell to 47.3, down from 52.6 in March and below last April’s 76.0.

About the surveys

The Surveys of Consumers represents a rotating panel survey at the University of Michigan Institute for Social Research. It is based on a nationwide representative sample ensuring equal probabilities of selection for each household in the contiguous U.S. Interviews are conducted online throughout the month. The minimal monthly change necessary for significance at the 95% level in the Sentiment Index is 4.8 points; for the Current Index and Expectations Index, the minimum is 6 points.